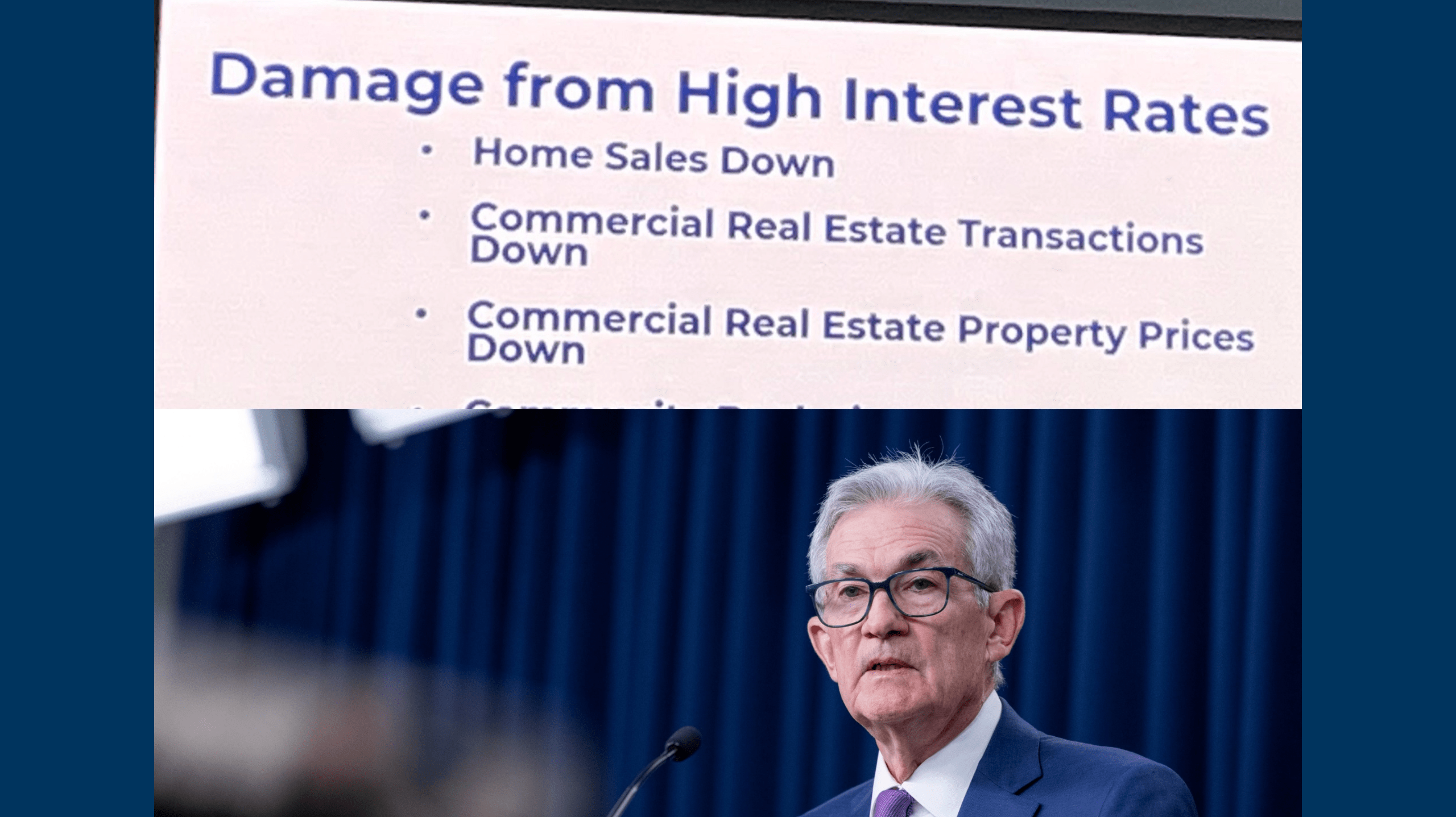

Fed. Reserve Chair Jerome Powell suggested people shouldn't expect interest rates to fall anytime soon, on Tuesday May 14, 2024.

© J. Kyle Foster / USA TODAY NETWORK +© Amanda Andrade-Rhoades for USA TODAY, Amanda Andrade-Rhoades

(Washington, DC) – On Tuesday, the market got more clarity as to what may be coming for the Federal Reserve and interest rates. Specifically, it looks like rate cuts are exceedingly unlikely anytime soon. First, wholesale inflation came in hotter-than-expected as the April PPI was more or less twice as high as what economists expected. That came ahead of the Wednesday CPI, which is a more often watched measure of inflation.

Then, speaking at a conference in Amsterdam, Federal Reserve Chairman Jerome Powell threw further cold water on the idea of a rate cut in the coming months. He said the Fed needs to be patient and let its hawkish policy have its intended impact. Earlier this year, veteran traders had considered a rate cut sometime this year likely — now that’s less certain.