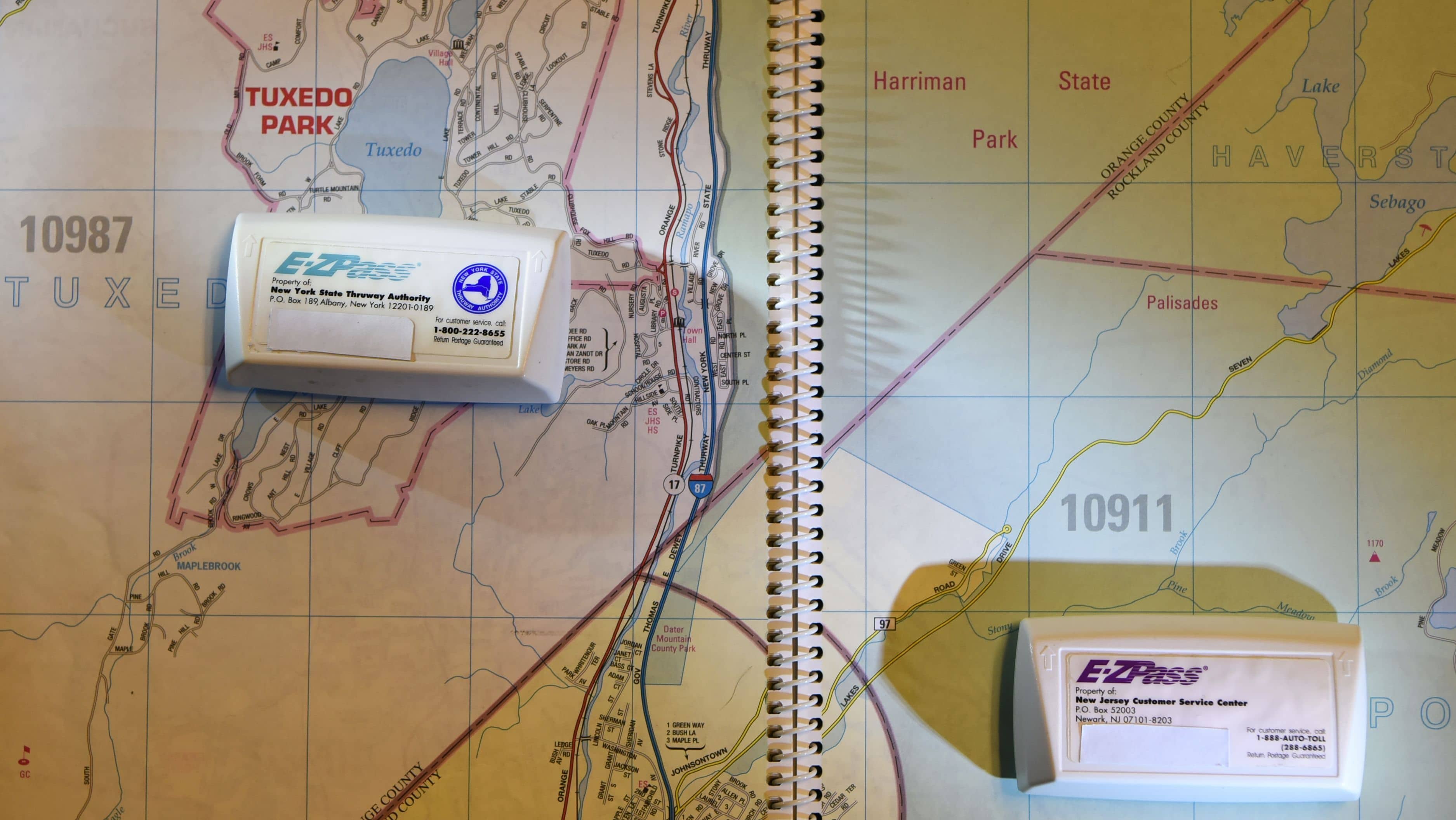

The differences between E-Z Pass NJ and E-Z Pass NY

© Anne-Marie Caruso/NorthJersey.com

(Trenton, NJ) — New Jersey lawmakers are considering letting drivers write off some of their E-Z Pass tolls. It’s a bipartisan bill that would let commuters who pay one-thousand-dollars in E-Z Pass tolls on any Jersey highway or bi-state bridge or tunnel during the year, deduct that amount from their state income tax.

Massachusetts has such a law, so it’s not a novel idea. But the bill has been stalled in the Senate Budget Committee since January. Proponents say it would give commuters a break in light of the recent increase in the state’s gasoline tax rate which helps fix roads.

There are five different versions of the proposals, but all said that E-Z Pass fees, fines or tolls that are considered business expenses and are reimbursed by an employer or deducted from federal taxes can’t be deducted under the bill. If approved by both houses of the legislature and signed in to law by Gov. Phil Murphy, New Jersey would extend a benefit to taxpayers that few states have and the IRS doesn’t allow — deducting the cost of commuting at least when it come to tolls paid.