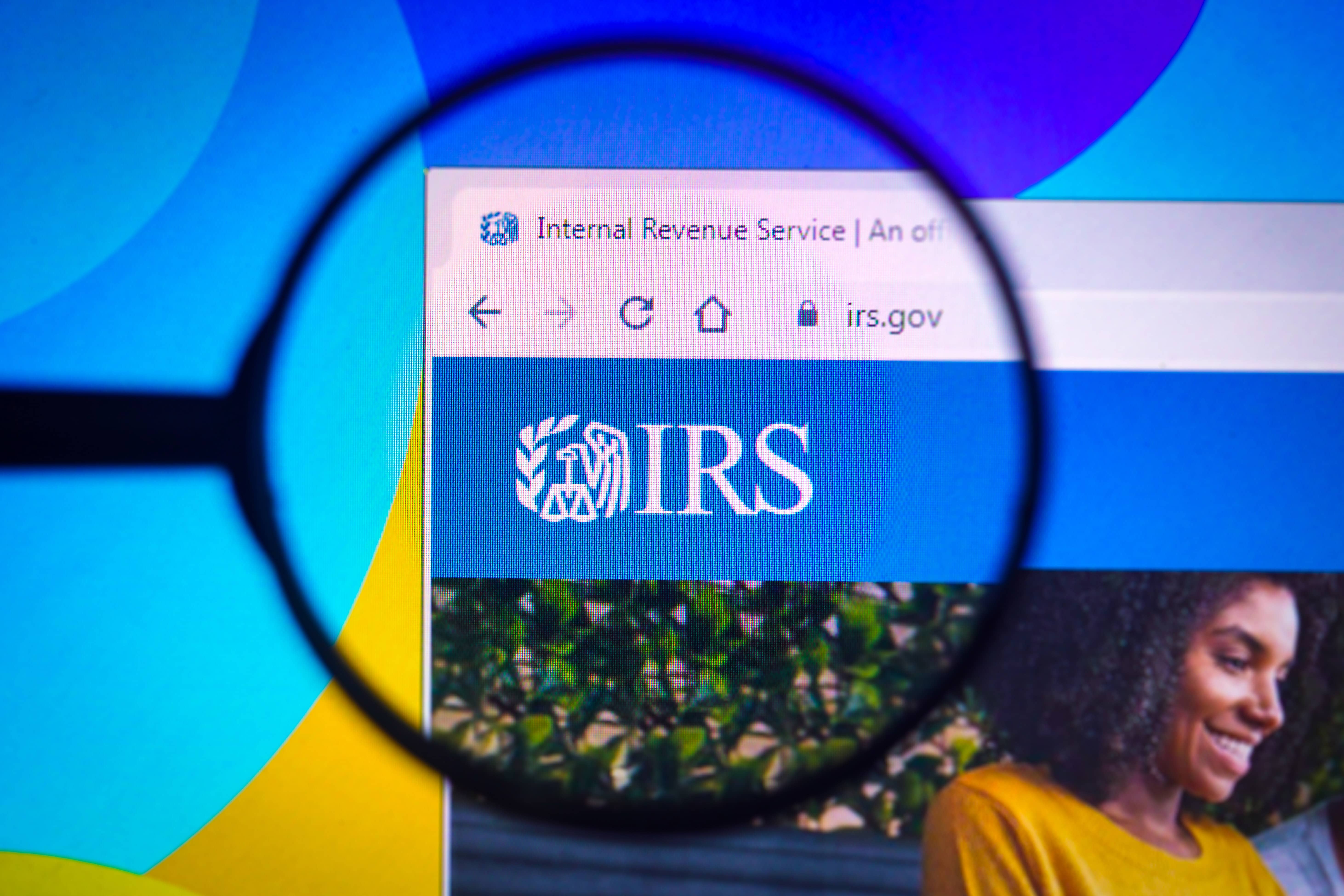

© SOPA Images

Photo illustration in Brazil – 22 May 2022

WASHINGTON (77WABC) — Republicans are crying foul because the IRS is reminding Americans they will have to report their $600 transactions on Venmo and PayPal to the Internal Revenue Service.

President Joe Biden’s American Rescue Plan requires taxpayers add to their 1099-K ‘gross payments for goods or services that exceed $600.’ The IRS posted an explainer Tuesday reminding taxpayers the reporting threshold for 1099-K forms is lowered from $20,000 to $600. The number of transactions that trigger receiving a form will also be lowered from 200 to 1.

This comes after the IRS received funding from the Inflation Reduction Act to hire 87,000 new agents. Republicans like House Majority Leader Kevin McCarthy have spoken out against this move.

The change applies to payments on third-party processors, such as Venmo or PayPal, and is for transactions such as part-time work, side jobs or selling goods. Failure to report such payments could trigger an audit since the IRS obtains a copy of the 1099-K form directly from third-party payment processors.